MATLAB and Simulink files to program the drawing robot, webcam controlled rover, and self-balancing motorcycle projects from AEK Rev 2.

: https://www.mathworks.com/help/supportpkg/arduinoio/ug/arduino-aek.htmlThis package includes the MATLAB and Simulink files used to program the three projects in the Arduino Engineering Kit Rev 2:• A drawing robot that takes a reference drawing and duplicates it on a

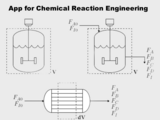

Simulation of basic concepts in chemical reaction engineering

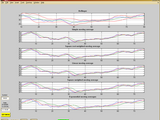

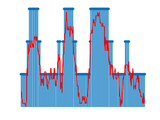

Financial stock market prediction

Financial stock market prediction of some companies like google and apple Any doubts pls contact emaal- josemebin@gmail.com

MATLAB and Simulink support for hardware components used in the Arduino Engineering Kit.

This package includes MATLAB and Simulink files that allow users to communicate with and control the sensors and actuators used in the Arduino Engineering Kit, most of which are connected through the

MATLAB and Simulink support for hardware components used in the Arduino Engineering Kit.

Note: This version is for MATLAB release R2018b only. For MATLAB R2018a please use this file here: https://www.mathworks.com/matlabcentral/fileexchange/66568-arduino_engineering

Generate Matlab table for ticker(s) queried through Alphavantage

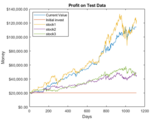

MATLAB example on how to use Reinforcement Learning for developing a financial trading model

Reinforcement Learning For Financial Trading ?How to use Reinforcement learning for financial trading using Simulated Stock Data using MATLAB.SetupTo run:Open RL_trading_demo.prjOpen workflow.mlxRun

Risk neutral densities for advanced financial models used for option pricing

We present methods for calculating the risk neutral density for several financial models. We consider:Black, Displaced Diffusion, CEV, SABR, Heston, Bates, Hull-White, Heston-Hull-White, VG, NIG

Developing a Financial Market Index Tracker using MATLAB OOP and Genetic Algorithms

Version 1.1.0.1

Mark HoyleFiles used in the webinar of the same name

Files used in the Webinar "Developing a Financial Market Index Tracker using MATLAB OOP and Genetic Algorithms" The zip file contains the data and files used to develop an application to track a

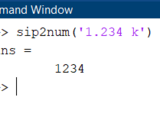

Convert SI-prefixed text (aka engineering / metric prefix) into numeric values. Bonus: binary prefixes!

The function SIP2NUM converts a string with an SI prefix (aka metric prefix, or engineering prefix) into a numeric value. For example the string '1 k' is converted to 1000. The bonus function BIP2NUM

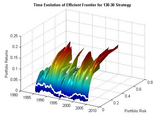

Scripts and data to demonstrate the new Portfolio object in Financial Toolbox.

A .zip file contains a series of scripts that were used in the MathWorks webinar "Using MATLAB to Optimize Portfolios with Financial Toolbox." The scripts demonstrate features of the Portfolio object

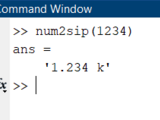

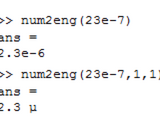

Convert a numeric value to SI-prefixed text (aka engineering / metric prefix). Bonus: binary prefixes!

The function NUM2SIP converts a numeric scalar into a string with an SI prefix (aka metric prefix, or engineering prefix). For example the value 1000 is converted to '1 k'. The bonus function NUM2BIP

Demos commonly used at The MathWorks financial modeling seminars.

Ten demos, most of which are shown at The MathWork's financial modeling seminars. All of the demos are in their own folders, which contain the code, and a ReadMe file that explains what the demos do

Improving MATLAB® performance when solving financial optimization problems

Version 1.0.0.1

Jorge PaloschiJorge Paloschi,PHD and Sri Krishnamurthy,CFA May 2011

Optimization algorithms are commonly used in the financial industry with examples including Markowitz portfolio optimization, Asset-Liability management, credit-risk management, volatility surface

AEK material (Arduino Engineering Kit)

Welcome!The following material is aimed at engineering students who want to acquiredifferent skills through the use of the Arduino Engineering Kit -threechallenging engineering projects- and the

Read Yahoo Stock price and generate ZigZag Wave.

MATLAB and Simulink files to program the drawing robot, mobile rover, and self-balancing motorcycle.

NOTE: This package contains the project files for Arduino Engineering Kit Rev 1. - For Arduino Engineering Kit Rev 2 project files, use this link

Customize automotive scenes in Unreal® Editor for co-simulation in Simulink®

MATLAB & Its Engineering Application

Matlab & Its Engineering Application - Presentation Its very useful for Matlab beginners

Presentation and M-Files for MathWorks Webinar

This zip file contains the Presentation (PDF) and M-files that were demonstrated in the MathWorks Webinar: Using Genetic Algorithms in Financial Applications delivered on Dec 11 2007.The purpose of

Carr-Madan and Lewis pricing methods using FFT for many advanced financial models

This is material from the bookFinancial Modelling: Theory, Implementation and Practice with Matlab source from Joerg Kienitz and Daniel Wetterau, WILEY, September 2012Pricing Call Options for

Random Matrix Theory (RMT) Filtering of Financial Time Series for Community Detection

Version 1.0.0.0

MelUses RMT to create a filtered correlation matrix from a set of financial time series price data

This function eigendecomposes a correlation matrix of financial time series and filters out the Market Mode Component and Noise Component, leaving only the components of the correlation matrix that

Automated Driving Toolbox Interface for Unreal Engine Projects

MathWorks Automated Driving Toolbox TeamCustomize automotive scenes in Unreal® Editor for co-simulation in Simulink®

MATLAB code of SNS algorithm for solving engineering optimization problems

Social Network Search (SNS) is a novel metaheuristic optimization algorithm, and its socrce code for solving mixed continuous/discrete engineering optimization problems is presented here. The SNS

The complete displacement diagram for all possible configuration of the linkages ...

LINKAGE MECHANISM (MECHANICAL ENGINEERING) The command xxx = mnism(r1,r3,l,r4,r5) example: xxx = mnism(3,5,6,6,8) -----------(1)gives two figures

These codes present various examples of engineering optimization and tuning the controllers’ gain.

The engineering optimization algorithms have been presented drastically recently, here is a simple method for constrained engineering optimization for both static and dynamic systems. The simplicity

Live scripts, files, and slides for "Engineering Design and Documentation with MATLAB" Demo

In the modern digital era, knowledge is expanding very quickly. Knowledge is becoming difficult to retain despite the vast amounts of information within software. How can the engineering and science

A set of MuPAD notebooks which allow engineering students to visualize and experiment with maths.

A set of hyperlinked maths notebooks which allow Y1 and Y2 engineering students to visualize and experiment with difficult maths concepts. The aim is to allow students to do lots of examples, in an

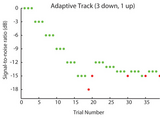

Determines what changes you should make to the signal during a psychoacoustic adaptive track.

(and has got models to prove it! :))

Simulink documentation is short on examples that are (a) simple and (b) do not come from the engineering domain. We present one that meets both criteria and so may aid another non-engineer curious

Simulation of basic concepts in chemical reaction engineering

Companion Software

Written for advanced undergraduate students, this book emphasizes the practical application of control systems engineering to the analysis and design of feedback systems.

Retrieve historical stock data from Yahoo! Finance

Convert numbers to engineering notation strings, or use SI-prefixes instead. Offers extensive customisation. Also works on axes tick labels.

Converts an input numerical value into an engineering-formatted string (as a character vector), in either scientific format with multiples-of-three exponent, or using SI prefixes e.g. k, M, n, p etc

Customize scenes in Unreal® Editor for co-simulation of autonomous flight algorithms in Simulink®

solves problems in engineering statics & dynamics

This is a toolbox of educational software for engineering students and professionals who are analyzing and designing static systems and dynamic systems. The software is used in ENGINEERING STATICS

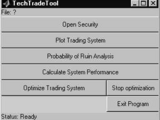

A toolbox for calculating and optimizing technical analysis trading systems.

programming language make this technical trader's toolbox easily extendable by adding new complicated systems with minimum programming effort.The theoretical work has been published in Financial Engineering

Companion Software

Written for advanced undergraduate students, this book emphasizes the practical application of control systems engineering to the analysis and design of feedback systems.For a full book description

Companion Software

Morphological characterisation and simplification of three-dimensional particle geometries

SHape Analyser for Particle Engineering What SHAPE does • Architectural features • File tree • Simple example • Credits • BYOS • Acknowledging

Companion Software

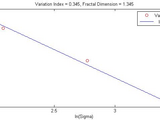

VARINDX calculates the variation index and fractal dimension of a financial time series.

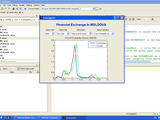

Display in the GUI evolution of the Finance in Moldova

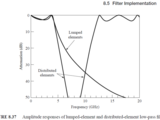

David Pozar Microwave Engineering

Engineering Optimization: An Introduction with Metaheuristic Applications

Version 1.0.0.0

Xin-She YangPSO, Firefly Algorithm

A GUI financial technical analysis toolbox.

Lynch files to accompany the book.

Lynch_Chaps.zip contains the MATLAB files, Simulink model files and a Tutorial Introduction to MATLAB for the new book, "Applications of Chaos and Nonlinear Dynamics in Engineering - Vol. 1". The

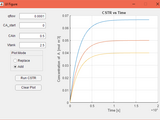

Dynamic model of CSTR from Engineering Dynamics ENG2120 coursework Case 3

This submission contains the models needed to control the Arduino Engineering Kit's mobile rover using an Android device.

The Arduino Engineering Kit offers 3 projects : Drawing Robot, Rover and a Motorcycle. In this submission, we show how to use an Android phone to control the rover. For more details about the kit

This code recursively generates K-subsets of an N-set.

Fault (power engineering)

Dissertation code for MSc in Financial Economics in City University London

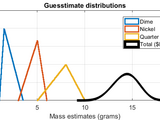

Tools for generating pseudorandom numbers, primarily geared toward making engineering estimates.

.slx files of questions in the book.

Analyze simulated financial data to through an Exploratory Factor Analysis class.

Companion Software

Structural Engineering of Microwave Antennas

Converts numbers to strings in engineering notation

Converts numbers to strings in engineering notation. Produces string (array) from numbers with mantissa and metric prefix (every third power of 10 between 1e-24 to 1e24).

This example shows how to analyze aspects of risk contagion in financial time series using various mathematical tools.

Exploring Risk Contagion Using Graph Theory and Markov ChainsRecent financial crises and periods of market volatility have heightened awareness of risk contagion and systemic risk among financial

Convert numbers to engineering notation.

Engineering notation is similar to scientific notation, except thatthe exponent power of 10 is always an integer multiple of 3, and themantissa is scaled so that it lies inside [0,1000). The range

A GUI application which conducts cycle analysis on a turbojet engine.